150 IRS Response Letter Templates

Discover How Quickly & Painlessly You Can Write Important IRS Letters with the Ultimate IRS Communicator!

An Exclusive Offer for CPAacademy.org Webinar Attendees.

The letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Discover how quickly and painlessly you can write those important letters using the collection of templates included in the Ultimate IRS Communicator. The collection is over 150 articulate letters that make your job so much easier and assures that you appear as the talented professional you are.

From now on you can have professionally written IRS letters at your fingertips. Imagine how much time you can save by having an arsenal of ready-to-go IRS letters sitting on your computer awaiting a few quick edits and voila, a perfect IRS letter is done and in the mail. The IRS will respond well to your professional approach and clients will be impressed with your expertise.

Determining the IRS address and the IRS official you want to receive the letter is somewhat of a puzzle these days. Not to worry, the Ultimate IRS Communicator contains most of the addresses you need or instructions on mailing to the IRS.

Letters are included for many situations including:

- Non-filer correspondence

- Delinquent tax cases

- IRS audit and examination matters

- Protests of IRS actions

- Employment and Trust Fund Recovery Penalty issues

- Many other issues facing troubled taxpayers

- See the full list of letters below!

Over 150 Pre-Written Letters and Templates

- You represent troubled taxpayers.

- You write letters on their behalf.

- You need this essential tool.

- Cut and Paste Simplicity

Letters are clear, to the point, and well-ordered.

No more blank computer screens, blank sheets of paper, or writer’s block.

Eliminate false starts, re-writes, and other time-waters.

NEW & IMPROVED!

Folder 1 – Introductory Material

Finding IRS Addresses Folder

How to Use

Table of Contents

About the Authors

Folder 2 – Letters to Clients

2A Engagement Letter - IRS Representation

2B Engagement Letter- Consultation

2C Engagement Letter-Return Preparation

2D Enrolled Agent Explanation

2E CPA Explanation

2F Attorney Explanation

2G Explanation of Professional Fees

2H Privacy Policy Notice

2I-1 Cir 230 Conflict of Interest Disclosure No.1

2I-2 Cir 230 Conflict of Interest Disclosure No. 2

2I-3 Conflict of Interest Waiver

2J Cir 230 Failure to File

2K-1 Cir 230 Notice of Error of Omission

2K-2 Cir 230 Notice of Error of Commission

2L-1 POA Transmittal Letter to Client

2L-2 POA Representation - Withdrawal Letter to Client

2M Consent to use tax return information

2N Employee or Independent Contractor Notice

2O No Substantial Authority

2P Backup Withholding Information

2Q Forms 1099K and 14420 Explanation

2R-1 Withholding Tax, Incorrect Employee

2R-2 Withholding Tax, Incorrect Employer

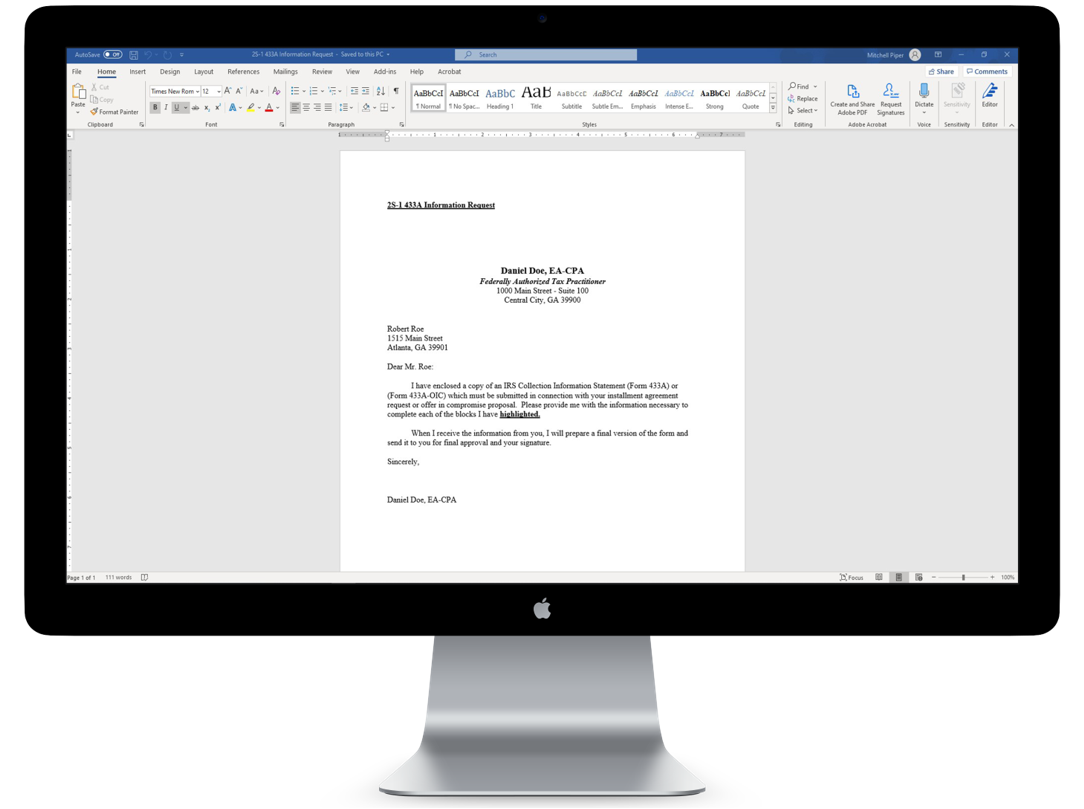

2S-1 433A Information Request

2S-2 433B Information Request

Folder 3 – Letters to IRS Examination Officials

3A-1 Notice of Examination Response

3A-2 Request for Exam at Representative Office

3A-3 Third Party Contacts (Exam)

3B IRS Letter 12C Response Sample

3C Math Error Contact Response

3D-1 Automatic Under Reporter Response

3D-2 Corres Exam First and Only Response

3E CAWR Discrepancy Reply

3F Examination Status Request

3G Examiner Conflict of Interest Notice

3H Qualified Offer Transmittal

3I Repetitive Audit Closure Request

3J Objection to Request for Voluntary Interview

3K Requested Documents IDR Transmittal

3L Examination Conclusion Request

3M-1 Managerial Review Request - Field Exam

3M-2 Managerial Review Request - Service Ctr Exam

3N Statute Extension Request Declined (Exam)

3O-1 Request for Corres Exam Transfer to Field

3O-2 Request for Corres Exam Transfer (Complex)

3P Examination Report Response

3Q Notice of Deficiency-Late Response

3R Request for Closing Agreement

3S-1 Audit Reconsideration Request (New Information)

3S-2 Audit Reconsideration Request (SFR)

3T Request for Corres. Exam Transfer to Appeals

3U Fast Track Mediation Request

3V Expense Reconstruction Transmittal

3W-1 1099K Written Explanation

3W-2 1099K Form 14420 NO

3W-3 1099K Form 14420 YES

Folder 4 – Letters to IRS Collection Officials

4A Adjustment Request

4B Designated Payment Letter

4C-1 Extension of Time to Pay

4C-2 Inability to Pay Installment Agreement (Under $10M)

4C-3 Inability to Pay Installment Agreement (to $25M)

4C-4 Inability to Pay Installment Agreement (Over $25M)

4C-5 Inability to Pay - Uncollectible

4C-6 Inability to Pay Installment Agreement (To be Submitted)

4C-7 Inability to Pay Form 433H

4C-8 Appeal- Denied Installment Agreement

4D-1 Collection Appeal (CAP) Step 1

4D-2 Collection Appeal (CAP) Step 2

4D-3 CDP Hearing Status

4E-1 CDP Hearing Request Levy

4E-2 CDP Hearing Request Lien

4F IRC Section 7433 Warning - Direct RO Contact

4G Levy Release Request - Payment of Govt Interest

4H-1 Lien Non-Filing Request

4H-2 Lien Release Request

4H-3 Lien Discharge Request

4H-4 Lien Subordination

4H-5 Lien Withdrawal Request

4H-6 Lien Non-Attachment Request

4I Managerial Review Request - Collection

4J-1 Non-filer (Not Liable)

4J-2 Non-filer (Return Previously Filed)

4J-3 Non-filer (TP Liable)

4J-4 6 Year Delinquent Return Transmittal

4K-1 Notice of Intent to Levy Response

4K-2 Wage Levy Release Request (Hardship)

4K-3 Bank Levy Release Request

4L-1 Inability to Pay - OIC

4L-2 OIC (Form 656) Transmittal

4L-3 OIC Acceptance Letter

4L-4 Appeal- Denied OIC

4M – Collection Statute Expired

4N-1 Third Party Contacts (Collection)

4N-2 Third Party Contact Violation

Folder 5 – Letters to IRS Appeals Officials

5A Appeal Request - Exam Under $25M

5B Appeal Request - Exam Over $25M

5C Appeals Early Referral Request

5D Appeal Conference Request Follow-up

5E Appeal Settlement Transmittal

5F Managerial Review Request - Appeals

5G Audit Reconsideration Appeal

Folder 6 – Letters concerning IRS Penalties

6A Penalty Non-Assertion Request

6B Penalty First Time Abate Request

6C Penalty Abatement Request (General)

6D-1 Penalty Reasonable Cause Statement Transmittal

6D-2 Reasonable Cause Statement - No Records

6D-3 Reasonable Cause Statement - Illness

6D-4 Reasonable Cause Statement-Ignorance of law

6D-5 Reasonable Cause Statement - Fire, Flood, Etc

6E Preparer Penalty Response

6F-1 Trust Fund Penalty Defense

6F-2 Declining Request for Form 4180 Interview

6F-3 Request for TFRP information

Folder 7 – Letters concerning IRS Administrative Matters

7F-1 POA Transmittal Letter to IRS

7F-2 POA Withdrawal Letter to IRS

7F-3 POA Withdrawal Letter to Client

7F-4 POA Bypass Warning Letter

7G IRS R&R Act Section 1203 Warning

7H Summons - Request for friendly

7I-1 Request for Campus Executive Intervention Level 1

7I-2 Request for Campus Executive Intervention Level 2

7J Memorandum of Telephone Call

7K Practitioner Liaison IMRS Submission

7L TAS Office of Systemic Advocacy Submission

Folder 8 – Letters to Clients concerning Tax Law

8A All Income Letter

8B Business Income Latter.

8C Trade or Business

8D Passive Losses

8E Qualified Business Income Deduction

8F Burden of Proof

8G Full Payment Requirement

8H Delegating Responsibility

8I Tax Law Changes

8J S-Corp Salary

Folder 9 – Quick Response Letters to IRS Contacts

9A Response to Letter 729 Delinquent Return

9B Response to CP501 Balance Due Notice

9C Response to IRS Letter 566 Correspondence Audit

9D Response to IRS Letter 2205 Field Audit

9E Response IRS Letter 3586 Meeting for TFRP Interview

| Company | ASTPS |

| Category | DISCOUNT |

| Original Cost | $90.00 |

| Discount | $10.00 |

| Cost | $80.00 |

| Intended Audience | CPA - small firm CPA - medium firm CPA - large firm Enrolled Agent |

These Templates Regularly Sell for $90.00 + $7.00 S&H

Order Now & Download All 150 Letter Templates in Microsoft Word Format Instantly For $80.00.

The download link will appear on screen once the purchase is complete!

ASTPS

(716) 630-1650

www.astps.org

The American Society of Tax Problem Solvers is a national non-profit membership association that was founded in 2003 to address the need for IRS Tax Problem Resolution Training and Mentoring. ASTPS offers live technical training conferences, case support & continuing education through membership, and certification opportunities for practitioners looking to specialize in tax problem resolution.